Shankar Sharma’s Savage Take: “India’s IPO Circus is the Dumbest Show on Earth” – Why Lenskart’s ₹70,000 Cr Valuation is the Latest Act

In a market where retail suckers multiply faster than crypto memes, Shankar Sharma calls out the Lenskart IPO frenzy as “organized chaos” – and he’s got receipts from Paytm’s graveyard.

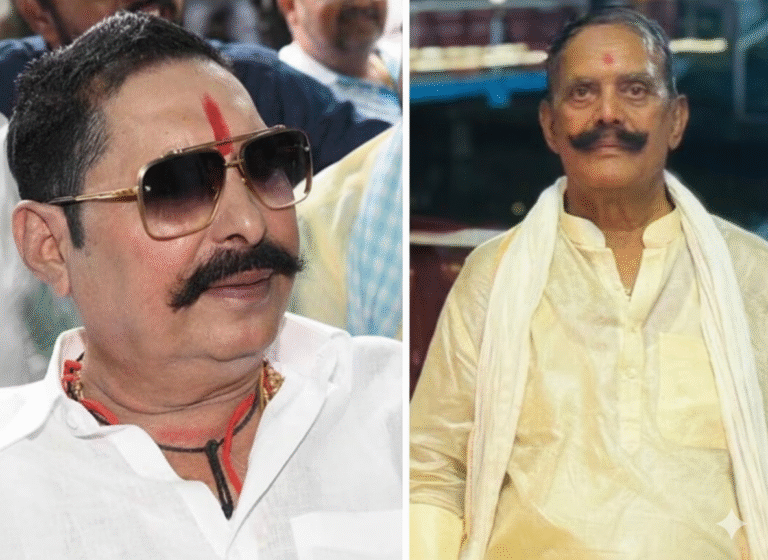

Shankar Sharma

Lenskart Drama

Retail Roast

Opening Salvo: Picture this: A Shark Tank shark swims into the IPO ocean, priced at a cool ₹70,000 crore – that’s $8.5 billion for those counting in dollars.

Enter Shankar Sharma, the grizzled market wizard who just dropped a truth nuke: “India’s the dumbest IPO market ever.” And Lenskart? Just the latest clown in the circus.

Buckle up – this isn’t investing advice; it’s a front-row seat to the greatest retail rip-off show.

The Lenskart Fiasco: From Shark Tank Darling to Valuation Villain

Ah, Lenskart – the eyewear empire built on Peyush Bansal’s no-BS grilling sessions on Shark Tank. Founded in 2010 as Valyoo, it exploded during the pandemic with affordable specs and aggressive omnichannel vibes. Fast-forward to 2025: Revenue hit ₹8,000 crore last fiscal (up 28% YoY), profits? A shiny ₹500 crore – up from zilch in 2023. Sounds peachy, right?

Enter the IPO beast: Opens October 31, price band ₹382-₹402 per share. Valuation? A whopping ₹70,000 crore, or 8.75x sales and 236x earnings. Anchor round? Bombshell – ₹3,268 crore from SBI MF (₹100 crore bite), HDFC MF, Franklin Templeton, and TPG. Oversubscribed on Day 1, retail and QIB quotas snapped up like free samples at a mall.

But here’s the spicy twist: Peyush reportedly scooped 4.26 crore shares at ₹52 apiece in July (₹222 crore loan-fueled deal). Three months later? IPO at 8x that. Netizens erupted: “Shark becomes the bait?” Bansal fires back: “Not a promoter exit – it’s for global conquest.” Fair play, or fox in the henhouse?

The IPO Timeline: From Hype to (Possible) Hangover

A quick rewind on Lenskart’s wild ride – because context is king in this clown show.

Valyoo launches as online eyewear disruptor. Early backers: SoftBank, TPG. Shark Tank fame seals the deal – Peyush grills, but invests ₹1 crore in one pitch.COVID catapults sales 5x. 1,000+ stores, app downloads skyrocket. Losses? ₹1,200 crore cumulative – classic growth story.Peyush grabs shares at ₹52 via ₹222 crore loan. Whispers of "insider prep?" SEBI shrugs – all above board.₹7,278 crore fresh issue + ₹5,000 crore OFS. Anchors pour in ₹3,268 crore. GMP? Hovering at ₹70-80 (18-20% premium).Fully subscribed. Retail frenzy, but Twitter roasts: "₹235-238 per ₹1 earned? Highway robbery!"Shankar’s Shredder: “Dumbest Market Ever” – And He’s Not Wrong

Shankar Sharma – the guy who nailed the 2008 crash and dodged the 2020 COVID dip – didn’t hold back on NDTV Profit. “India’s the dumbest IPO market in history,” he thundered. Why? “Billions from retail suckers every microsecond.” Lenskart’s sin? Daring to price at a “modest” 10x sales when Paytm, Nykaa, Zomato, Policybazaar, and CarTrade IPO’d at 25-50x – then cratered 40-80% post-listing.

“The poor chap [Peyush] is underpricing himself,” Sharma quipped. “Why kill him? Blame the anchors – SBI, HDFC – who hyped those bombs.” He spots an “organized campaign” via social media: Anchoring bias at play. “Get a hot IPO, collect cash, watch it tank. Capitalism’s beautiful game.” And the kicker? “Suckers born every minute? In India, every microsecond.”

Sharma’s no Lenskart shareholder – “I don’t wear specs, never bought any” – but his X post lit the fuse: “Organized hit job. At 10x, it’s a steal vs. the 50x disasters.” Echoes from ET: “Ghor paap kya kar raha Lenskart?” Critics like Jayant Mundhra slam: “Profit like a rabbit from a hat – overseas fluff, franchise lawsuits ignored.”

The Valuation Vortex: Lenskart vs. The Fallen Tech Titans

Let’s crunch the circus numbers – because Sharma’s got a point.

Lenskart: 8.75x sales (₹8,000 Cr rev), 236x earnings (₹500 Cr profit). Grey market premium? Slipped to 18% from 27% – cooling jets? Compare to the ghosts:

- Paytm (2021): 50x sales, tanked 75% in a year. Losses? Endless.

- Nykaa (2021): 25x, now 60% off highs. Beauty boom busted.

- Zomato (2021): 40x, halved post-IPO. Food delivery feast turned famine.

- Policybazaar (2021): 30x, still licking wounds at -50%.

Sharma’s verdict: “Buyer beware – regulator greenlit it. If it flops, that’s on you.” But with TPG’s ₹4,000 Cr pre-IPO bet and global push (Japan stores incoming), is Lenskart the phoenix or another flop?

IPO Survival Kit: Don’t Be the Sucker in Sharma’s Microsecond

- Check multiples: 10x sales? Bargain vs. 50x ghosts – but verify profits aren’t “hat rabbits.”

- Anchor autopsy: SBI’s ₹100 Cr? Big names love it – but they dumped Paytm too.

- GMP gospel? 18% premium screams hype – wait for listing day fireworks.

- Retail reality: You’re last in line – QIBs grab the goodies first.

- Sharma’s shade: “Beautiful game” means promoters win, you chase shadows.

- Long game: Lenskart’s 1,000 stores + Shark fame? Could outlast the fad.

Curtain Call: Lenskart’s Encore or Exit Stage Left?

In the grand IPO theater, Shankar Sharma’s the heckler stealing the show. Lenskart? Oversubscribed starlet with a ₹70K Cr spotlight – but shadows of Paytm loom large.

Will Peyush’s specs empire sparkle or shatter? Listing day (Nov 6?) will spill the beans. Until then, heed Sharma: In India’s dumbest market, the only sure bet is the house always wins.

Sharma’s Swan Song:

“Suckers every microsecond? That’s not investing – that’s the Indian IPO ritual.”

Play wisely, or become the punchline.

![]()